B.P. Securities (India) Pvt. Ltd. Introduce InsatntFunds a Hassle-Free Personal Loan Platform

Are you in need of quick financial assistance? Whether it’s for an emergency, a long-awaited vacation, or fulfilling any personal needs, B.P. Securities (India) Pvt. Ltd. has got you covered. InstantFunds is not just another personal loan provider; it’s your gateway to fast and hassle-free personal loans. Let’s take a closer look at what makes InstantFunds the ideal solution for your immediate financial needs.

Swift, Online Loans at Your Fingertips

InstantFunds By B.P. Securities (India) Pvt. Ltd. is an instant personal loan app that understands the value of your time. With this user-friendly application, you can apply for a personal loan and have the funds disbursed to your bank account in just 15 minutes. Yes, you read that right – 15 minutes! Gone are the days of lengthy approval processes and waiting for funds to come through.

Loans for Everyone

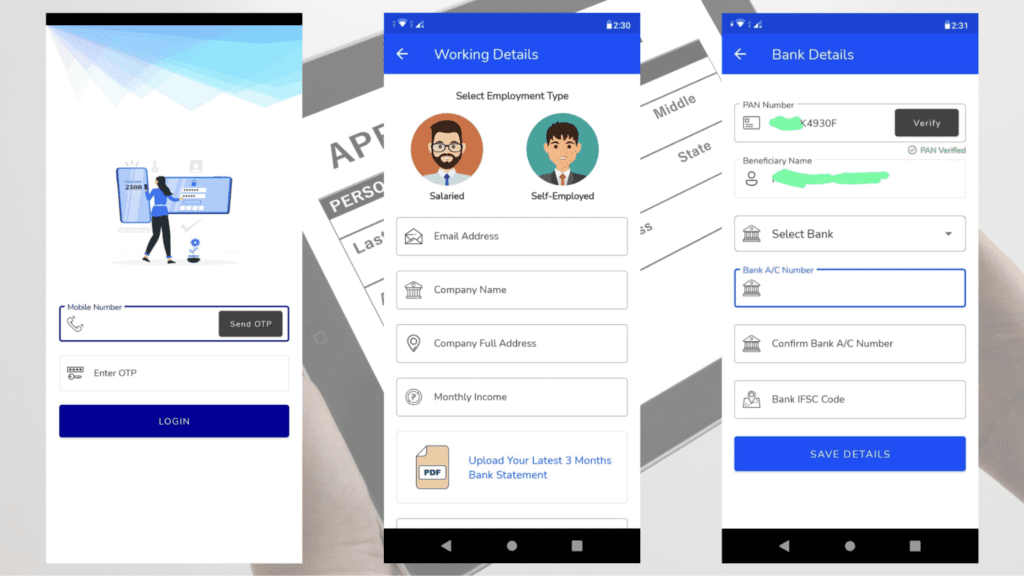

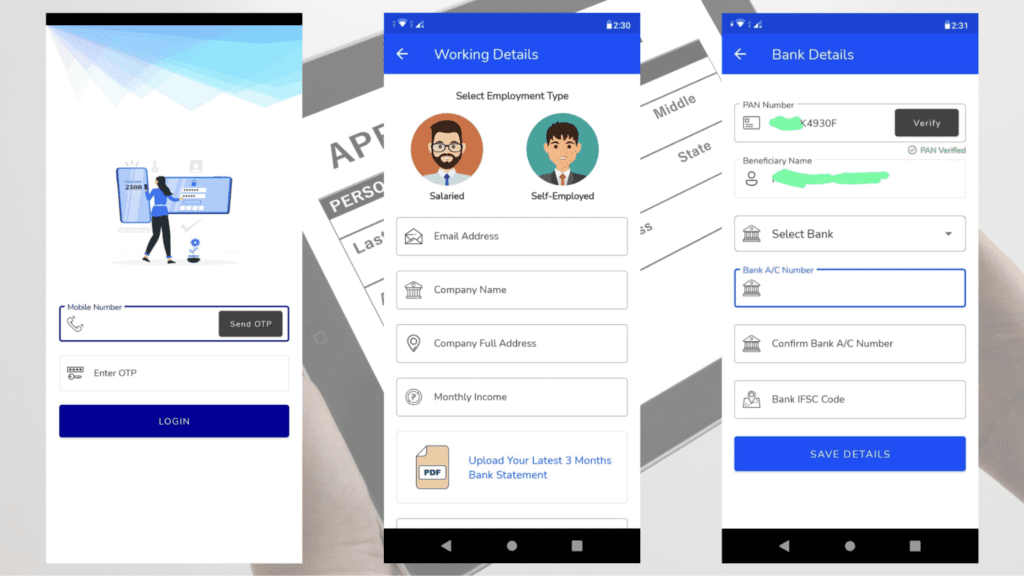

Whether you are a salaried individual or self-employed, InstantFunds caters to all. It ensures that everyone has access to quick funds without any unnecessary complications. No matter what your employment type is, you can rely on InstantFunds to be your financial lifeline.

Key Product Features Of InstantFunds

InstantFunds offers a range of features to make your borrowing experience smooth and convenient:

- Loan Amounts: Borrow anywhere from ₹5,000 to ₹5,00,000, depending on your requirements.

- Interest Rates: Enjoy competitive interest rates ranging from 12% to 29.95% per annum, ensuring affordable repayment options.

- Flexible Tenures: Choose tenures that fit your financial situation, ranging from 90 days to 24 months.

- Low Transaction Fees: Say goodbye to exorbitant transaction fees. InstantFunds believes in keeping costs reasonable.

- Quick Loans and Easy EMIs: Get the funds you need swiftly and enjoy manageable monthly instalments.

Loan Eligibility Made Simple By B.P. Securities (India) Pvt. Ltd.

B.P. Securities (India) Pvt. Ltd. has simplified the loan eligibility criteria:

- Age: Anyone between 21 and 65 years can apply for a personal loan.

- Employment Type: Whether you’re salaried or self-employed, you are eligible to apply.

- Minimum Net Income: A monthly income of ₹10,000 is the only requirement.

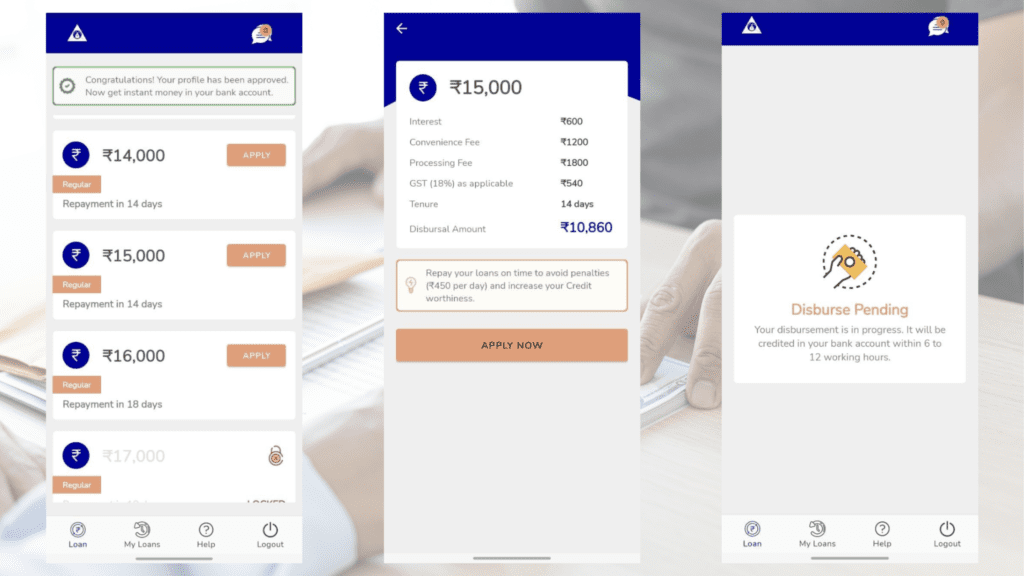

How to Avail a Loan

Getting a loan with InstantFunds is a breeze:

- Install the InstantFunds app.

- Sign up using your mobile number.

- Provide your Aadhaar and PAN numbers to check your eligibility.

- Complete a paperless KYC process.

- Select your desired loan amount and tenure.

- Provide your bank details.

- Request the money transfer to your bank account.

Loan Example

Let’s consider an example of a personal loan for a salaried individual:

- Loan Amount: ₹50,000

- Tenure: 6 months

- Rate of Interest: 18% per annum

- Processing Fee: ₹800 (1.70%)

- Onboarding Fee: ₹800 (1.70%)

- GST on Onboarding and Processing Fee: ₹288

- Total Interest: ₹4,500

- APR (Annual Percentage Rate): 29.528%

- Amount Disbursed: ₹43,612

- Total Repayment Amount: ₹50,000

Trusted Finance Partner

InstantFunds collaborates with B.P. Securities (India) Pvt. Ltd. to ensure reliable and secure financial transactions. You can rest assured that your financial well-being is in capable hands.

So, if you find yourself in need of financial assistance, don’t hesitate. Turn to InstantFunds and experience the simplicity and speed of obtaining a personal loan. Say goodbye to long waits and complex approval processes. InstantFunds is here to make your life easier and more financially secure. Download the app and unlock a world of possibilities with quick, hassle-free personal loans today!